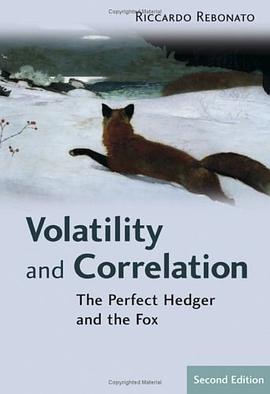

Volatility and Correlation pdf epub mobi txt 电子书 下载 2026

- 金融

- finance

- quant

- 数学

- Volatility

- trading

- 统计学

- 经济学

- 金融

- 波动率

- 相关性

- 风险管理

- 衍生品

- 市场分析

- 统计模型

- 经济学

- 投资

- 量化

具体描述

In Volatility and Correlation 2 nd edition: The Perfect Hedger and the Fox , Rebonato looks at derivatives pricing from the angle of volatility and correlation. With both practical and theoretical applications, this is a thorough update of the highly successful Volatility & Correlation – with over 80% new or fully reworked material and is a must have both for practitioners and for students. The new and updated material includes a critical examination of the ‘perfect-replication’ approach to derivatives pricing, with special attention given to exotic options; a thorough analysis of the role of quadratic variation in derivatives pricing and hedging; a discussion of the informational efficiency of markets in commonly-used calibration and hedging practices. Treatment of new models including Variance Gamma, displaced diffusion, stochastic volatility for interest-rate smiles and equity/FX options. The book is split into four parts. Part I deals with a Black world without smiles, sets out the author’s ‘philosophical’ approach and covers deterministic volatility. Part II looks at smiles in equity and FX worlds. It begins with a review of relevant empirical information about smiles, and provides coverage of local-stochastic-volatility, general-stochastic-volatility, jump-diffusion and Variance-Gamma processes. Part II concludes with an important chapter that discusses if and to what extent one can dispense with an explicit specification of a model, and can directly prescribe the dynamics of the smile surface. Part III focusses on interest rates when the volatility is deterministic. Part IV extends this setting in order to account for smiles in a financially motivated and computationally tractable manner. In this final part the author deals with CEV processes, with diffusive stochastic volatility and with Markov-chain processes. Praise for the First Edition: “In this book, Dr Rebonato brings his penetrating eye to bear on option pricing and hedging.… The book is a must-read for those who already know the basics of options and are looking for an edge in applying the more sophisticated approaches that have recently been developed.”

—Professor Ian Cooper, London Business School “Volatility and correlation are at the very core of all option pricing and hedging. In this book, Riccardo Rebonato presents the subject in his characteristically elegant and simple fashion…A rare combination of intellectual insight and practical common sense.”

—Anthony Neuberger, London Business School

作者简介

目录信息

读后感

讲了很多“为什么”,而不是象一般的书那样一上来就是一堆式子和假设却不说为什么要这么做。 BTW,谁有这本书的电子版的其中的表格和插图...... 我的表格和插图都没有,有点不爽啊......

评分讲了很多“为什么”,而不是象一般的书那样一上来就是一堆式子和假设却不说为什么要这么做。 BTW,谁有这本书的电子版的其中的表格和插图...... 我的表格和插图都没有,有点不爽啊......

评分讲了很多“为什么”,而不是象一般的书那样一上来就是一堆式子和假设却不说为什么要这么做。 BTW,谁有这本书的电子版的其中的表格和插图...... 我的表格和插图都没有,有点不爽啊......

评分讲了很多“为什么”,而不是象一般的书那样一上来就是一堆式子和假设却不说为什么要这么做。 BTW,谁有这本书的电子版的其中的表格和插图...... 我的表格和插图都没有,有点不爽啊......

评分虽然目前只看到100页,但是已经完全被作者折服了。 由一个二叉树就能推到change of numeraire, 讲透 risk neutral 的本质,并且将现代金融理论的两块基石BSM和CAPM联系在一起。 有一种豁然开朗,拍案叫绝的冲动。 强烈推荐。 如果说John hull的书是敲门砖,那么这本应该真的...

用户评价

在一次偶然的机会,我读到了一篇关于《Volatility and Correlation》的评论,评论中提到这本书对理解金融市场的“脉搏”有着独到的见解。虽然我并非金融专业的科班出身,但我经营着一家小型对冲基金,对市场的风险管理和资产配置有着切身的体会。我经常感到,尽管我拥有大量的市场数据和技术分析工具,但总是在对市场的剧烈波动和资产之间错综复杂的关系感到束手无策。这本书的书名直接击中了我的痛点。我希望它能够用一种更加直观、易于理解的方式,向我解释波动率和相关性是如何形成的,它们又会如何影响我的基金表现。我期望作者能够提供一些切实可行的策略,帮助我更好地识别潜在的风险信号,以及如何利用市场的联动性来构建更具弹性的投资组合。例如,在市场情绪剧烈波动时,如何调整仓位?在不同资产的相关性出现异常变化时,如何及时止损或规避风险?如果书中能提供一些案例分析,展示一些成功的交易员或基金经理是如何运用对波动率和相关性的深刻理解来规避风险、抓住机遇的,那对我来说将是无价之宝。

评分坦白说,我是在一次偶然的机会,在一位资深交易员的书架上瞥见了这本书。当时我的目光就被它沉稳大气的封面所吸引,随后了解到它是一本关于金融市场中“波动率”和“相关性”的专著。我从事量化交易已有数年,深知这两个概念在模型构建、风险控制以及策略开发中的核心地位。虽然我目前的工作主要集中在算法交易和高频交易领域,但我始终认为,扎实的理论基础是突破瓶颈、实现持续盈利的关键。因此,我非常渴望从这本书中挖掘出新的视角和方法。我期待它能为我揭示不同市场环境下,波动率和相关性的内在驱动因素,以及它们如何相互作用,从而影响资产价格的运动轨迹。或许,书中会提供一些关于如何更有效地预测未来波动率的方法,或者如何捕捉市场中转瞬即逝的相关性机会。我希望作者能够用清晰的语言,辅以详实的数学推导和图表,将复杂的概念解释得易于理解。最重要的是,我希望这本书能够提供一些能够直接应用于实践的洞见,比如如何设计能够适应不同波动率和相关性模式的交易策略,或者如何利用这些信息来优化我的交易系统。

评分我是一名对金融工程领域充满好奇的业余投资者,平时喜欢阅读一些介绍金融模型和量化策略的书籍。当我在书店的金融类区域看到《Volatility and Correlation》这本书时,我的兴趣被深深地吸引了。这本书的书名听起来就非常有技术含量,同时也暗示了它将探讨金融市场中最具挑战性的两个核心概念。我推测这本书会详细介绍各种衡量波动率的方法,或许会涉及一些复杂的统计模型,比如隐马尔科夫模型或者状态空间模型。对于相关性,我猜想作者会深入探讨如何理解和量化不同资产之间的相互影响,以及这些影响是如何随着时间变化的。我特别期待的是,这本书是否会解释这些概念在构建低风险投资组合中的作用,比如如何通过分散投资来降低整体的波动性,或者如何利用资产之间的低相关性来获得超额收益。我也希望书中能包含一些关于如何运用这些理论来理解和预测金融危机发生的原因,以及如何利用模型来评估和管理系统性风险。如果书中能够用清晰的语言,辅以图表和简单的实例,将这些复杂的理论呈现出来,那对我这样的非专业人士来说,将是极大的福音。

评分作为一个对金融理论和实证研究都抱有浓厚兴趣的研究生,我一直在寻找能够深化我对市场微观结构和资产定价理解的学术文献。《Volatility and Correlation》这个书名立刻吸引了我,因为波动率和相关性正是构成现代金融理论基石的两个重要支柱。我猜测这本书的写作风格会偏向学术,可能会引用大量最新的研究成果,并且在方法论上会非常严谨。我希望能从中学习到关于波动率的各种前沿模型,例如,是否会详细介绍条件异方差模型(ARCH/GARCH)的演变,以及如何处理非线性波动率的动态?同时,在相关性方面,我希望能够深入理解多元时间序列中的协方差矩阵估计和分解技术,以及如何处理时变的、非对称的相关性。我尤其期待书中能够探讨波动率和相关性在风险中性定价、期权定价模型(如BSM的扩展,或者随机波动率模型)中的具体应用,以及它们如何影响金融产品的定价和对冲。如果书中能提供关于如何检验这些模型在不同资产类别(股票、债券、外汇、商品)和不同市场(成熟市场、新兴市场)上的适用性,那将极大地拓展我的研究视野。

评分这本书的书名叫做《Volatility and Correlation》,虽然我还没有来得及通读全书,但仅凭封面的设计、作者的履历(我查了一下,作者在金融工程领域颇有建树,有过深厚的学术背景和实践经验),以及我初步翻阅时感受到的严谨的学术态度,我就对它充满了期待。从目录的概览来看,这本书似乎深入探讨了金融市场中两种至关重要的概念——波动率和相关性。我想象着它会详细解析各种度量波动率的统计方法,比如历史波动率、隐含波动率,或许还会涉及一些更前沿的波动率模型,例如GARCH系列或者随机波动率模型。对于相关性,我猜测书中会从基础的线性相关讲起,进而深入到更复杂的条件相关性、动态相关性,甚至可能触及协方差矩阵的估计和管理。我特别感兴趣的是,作者是否会提供一些实际案例,通过真实的市场数据来论证理论模型,比如如何利用这些工具来构建风险对冲策略,或者进行投资组合的优化。如果书中能对这些概念在风险管理、衍生品定价、以及资产配置等方面的应用提供深入的洞察,那将是极大的收获。我期望这本书能够不仅仅停留在理论层面,更能为我提供一套切实可行的分析框架和工具,帮助我更好地理解和驾驭复杂多变的金融市场。

评分什么,你没看过?那你也敢交易?

评分什么,你没看过?那你也敢交易?

评分什么,你没看过?那你也敢交易?

评分什么,你没看过?那你也敢交易?

评分老实说,有些too practical了

相关图书

本站所有内容均为互联网搜索引擎提供的公开搜索信息,本站不存储任何数据与内容,任何内容与数据均与本站无关,如有需要请联系相关搜索引擎包括但不限于百度,google,bing,sogou 等

© 2026 onlinetoolsland.com All Rights Reserved. 本本书屋 版权所有