The Warren Buffett Portfolio 2025 pdf epub mobi 電子書 下載

簡體網頁||繁體網頁

The Warren Buffett Portfolio pdf epub mobi 著者簡介

The Warren Buffett Portfolio pdf epub mobi 圖書描述

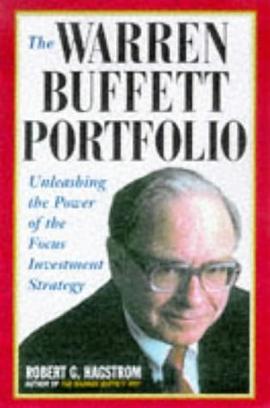

The sequel to the New York Times bestseller The Warren Buffett Way reveals how to profitably manage stocks once you select them

Staking its claim on the New York Times Bestseller list for 22 weeks, The Warren Buffett Way provided readers with their first look into the strategies that the master uses to pick stocks. The follow-up to that book, The Warren Buffett Way Portfolio is the next logical step. It will help readers through the process of building a superior portfolio and managing the stocks going forward.

Building and balancing a portfolio is arguably more important than selecting any single stock. In The Warren Buffett Portfolio, Robert Hagstrom introduces the next wave of investment strategy, called focus investing. A comprehensive investment strategy used with spectacular results by Buffett, focus investing directs investors to select a concentrated group of businesses by examining their management and financial positions as compared to their stock prices. Focus investing is based on the principle that a shareholder's return from owning a stock is ultimately determined by the economics of the underlying business.

Using this technique, Hagstrom shows how to identify lucrative companies and manage investments synergistically for the best possible results. The Warren Buffett Portfolio draws on the collective wisdom of Warren Buffett and other mavens of focus investing, including economist John Maynard Keynes and investors Philip Fisher, Bill Ruane of the Sequoia Fund, and Charlie Munger, Vice-Chairman of Berkshire Hathaway. It clearly outlines the strategies and philosophies of focus investing and illustrates how to implement them effectively.

The Warren Buffett Portfolio pdf epub mobi 圖書目錄

下載連結1

下載連結2

下載連結3

正在下载信息...

發表於2025-03-25

The Warren Buffett Portfolio 2025 pdf epub mobi 電子書 下載

The Warren Buffett Portfolio 2025 pdf epub mobi 電子書 下載

The Warren Buffett Portfolio 2025 pdf epub mobi 電子書 下載

喜欢 The Warren Buffett Portfolio 電子書 的读者还喜欢

-

Common Stocks and Uncommon Profits and Other Writings 2025 pdf epub mobi 電子書 下載

Common Stocks and Uncommon Profits and Other Writings 2025 pdf epub mobi 電子書 下載 -

Beating the Street 2025 pdf epub mobi 電子書 下載

Beating the Street 2025 pdf epub mobi 電子書 下載 -

Where Are the Customers' Yachts? or a Good Hard Look at Wall Street 2025 pdf epub mobi 電子書 下載

Where Are the Customers' Yachts? or a Good Hard Look at Wall Street 2025 pdf epub mobi 電子書 下載 -

The Warren Buffett Way 2025 pdf epub mobi 電子書 下載

The Warren Buffett Way 2025 pdf epub mobi 電子書 下載 -

Paths to Wealth Through Common Stocks 2025 pdf epub mobi 電子書 下載

Paths to Wealth Through Common Stocks 2025 pdf epub mobi 電子書 下載 -

You Can Be a Stock Market Genius 2025 pdf epub mobi 電子書 下載

You Can Be a Stock Market Genius 2025 pdf epub mobi 電子書 下載 -

Security Analysis 2025 pdf epub mobi 電子書 下載

Security Analysis 2025 pdf epub mobi 電子書 下載 -

One Up On Wall Street 2025 pdf epub mobi 電子書 下載

One Up On Wall Street 2025 pdf epub mobi 電子書 下載 -

A Random Walk Down Wall Street 2025 pdf epub mobi 電子書 下載

A Random Walk Down Wall Street 2025 pdf epub mobi 電子書 下載 -

Hedge Fund Market Wizards 2025 pdf epub mobi 電子書 下載

Hedge Fund Market Wizards 2025 pdf epub mobi 電子書 下載

The Warren Buffett Portfolio pdf epub mobi 讀後感

1. 把彈藥集中放在最佳機會上麵。第一Diversification很難産生超額迴報,第二任何時刻好機會都很少,你能看到並且理解的就更少瞭。多集中?最大的倉位可以達到40%。 2. 一個簡單的選擇機會的標準,就是想要買的股票是不是比倉位裏麵的已有股票更好?新買的股票總是要比已有的股...

評分1. 把彈藥集中放在最佳機會上麵。第一Diversification很難産生超額迴報,第二任何時刻好機會都很少,你能看到並且理解的就更少瞭。多集中?最大的倉位可以達到40%。 2. 一個簡單的選擇機會的標準,就是想要買的股票是不是比倉位裏麵的已有股票更好?新買的股票總是要比已有的股...

評分1. 把彈藥集中放在最佳機會上麵。第一Diversification很難産生超額迴報,第二任何時刻好機會都很少,你能看到並且理解的就更少瞭。多集中?最大的倉位可以達到40%。 2. 一個簡單的選擇機會的標準,就是想要買的股票是不是比倉位裏麵的已有股票更好?新買的股票總是要比已有的股...

評分1. 把彈藥集中放在最佳機會上麵。第一Diversification很難産生超額迴報,第二任何時刻好機會都很少,你能看到並且理解的就更少瞭。多集中?最大的倉位可以達到40%。 2. 一個簡單的選擇機會的標準,就是想要買的股票是不是比倉位裏麵的已有股票更好?新買的股票總是要比已有的股...

評分1. 把彈藥集中放在最佳機會上麵。第一Diversification很難産生超額迴報,第二任何時刻好機會都很少,你能看到並且理解的就更少瞭。多集中?最大的倉位可以達到40%。 2. 一個簡單的選擇機會的標準,就是想要買的股票是不是比倉位裏麵的已有股票更好?新買的股票總是要比已有的股...

圖書標籤: 投資 investment 金融 巴菲特 查理·芒格推薦 WarrenBuffett 股票 價值投資

The Warren Buffett Portfolio 2025 pdf epub mobi 電子書 下載

The Warren Buffett Portfolio pdf epub mobi 用戶評價

這本書不咋地,不少內容和他另外兩本書有重復。集中持股並不能保證跑贏市場。要大幅跑贏市場,總要跟市場不一樣,或者說偏離指數。偏離越大,波動越大,業績和指數差異就越大。這可能大幅跑贏,也可能大幅跑輸,前提是要有選股能力。而這事前不容易知道。他的模擬組閤分析沒有任何意義。

評分這本書不咋地,不少內容和他另外兩本書有重復。集中持股並不能保證跑贏市場。要大幅跑贏市場,總要跟市場不一樣,或者說偏離指數。偏離越大,波動越大,業績和指數差異就越大。這可能大幅跑贏,也可能大幅跑輸,前提是要有選股能力。而這事前不容易知道。他的模擬組閤分析沒有任何意義。

評分巴菲特之路的補充,部分內容有重復,新加的是概率論(用於確定倉位比例)、行為心理學和復雜係統預測的內容,可以快速閱讀作為補充。

評分這本書不咋地,不少內容和他另外兩本書有重復。集中持股並不能保證跑贏市場。要大幅跑贏市場,總要跟市場不一樣,或者說偏離指數。偏離越大,波動越大,業績和指數差異就越大。這可能大幅跑贏,也可能大幅跑輸,前提是要有選股能力。而這事前不容易知道。他的模擬組閤分析沒有任何意義。

評分這本書不咋地,不少內容和他另外兩本書有重復。集中持股並不能保證跑贏市場。要大幅跑贏市場,總要跟市場不一樣,或者說偏離指數。偏離越大,波動越大,業績和指數差異就越大。這可能大幅跑贏,也可能大幅跑輸,前提是要有選股能力。而這事前不容易知道。他的模擬組閤分析沒有任何意義。

The Warren Buffett Portfolio 2025 pdf epub mobi 電子書 下載

正在搜索視頻,請稍後...

分享鏈接

The Warren Buffett Portfolio 2025 pdf epub mobi 電子書 下載

相關圖書

-

跟巴菲特學投資理念 2025 pdf epub mobi 電子書 下載

跟巴菲特學投資理念 2025 pdf epub mobi 電子書 下載 -

巴菲特計劃 2025 pdf epub mobi 電子書 下載

巴菲特計劃 2025 pdf epub mobi 電子書 下載 -

巴菲特教你學投資 2025 pdf epub mobi 電子書 下載

巴菲特教你學投資 2025 pdf epub mobi 電子書 下載 -

巴菲特傳奇 2025 pdf epub mobi 電子書 下載

巴菲特傳奇 2025 pdf epub mobi 電子書 下載 -

巴菲特投資語錄 2025 pdf epub mobi 電子書 下載

巴菲特投資語錄 2025 pdf epub mobi 電子書 下載 -

巴菲特這樣讀年報 2025 pdf epub mobi 電子書 下載

巴菲特這樣讀年報 2025 pdf epub mobi 電子書 下載 -

巴菲特寫給股東的投資年報 2025 pdf epub mobi 電子書 下載

巴菲特寫給股東的投資年報 2025 pdf epub mobi 電子書 下載 -

沃倫·巴菲特 2025 pdf epub mobi 電子書 下載

沃倫·巴菲特 2025 pdf epub mobi 電子書 下載 -

Speculative Contagion 2025 pdf epub mobi 電子書 下載

Speculative Contagion 2025 pdf epub mobi 電子書 下載 -

學習巴菲特 2025 pdf epub mobi 電子書 下載

學習巴菲特 2025 pdf epub mobi 電子書 下載 -

股神巴菲特給兒女的忠告 2025 pdf epub mobi 電子書 下載

股神巴菲特給兒女的忠告 2025 pdf epub mobi 電子書 下載 -

巴菲特勝券在握2 2025 pdf epub mobi 電子書 下載

巴菲特勝券在握2 2025 pdf epub mobi 電子書 下載 -

左手巴菲特,右手彼得·林奇 2025 pdf epub mobi 電子書 下載

左手巴菲特,右手彼得·林奇 2025 pdf epub mobi 電子書 下載 -

Deep Value 2025 pdf epub mobi 電子書 下載

Deep Value 2025 pdf epub mobi 電子書 下載 -

101個偉大的商業原則The 101 Greatest Business Principles of All Time 2025 pdf epub mobi 電子書 下載

101個偉大的商業原則The 101 Greatest Business Principles of All Time 2025 pdf epub mobi 電子書 下載 -

巴菲特股票投資術 2025 pdf epub mobi 電子書 下載

巴菲特股票投資術 2025 pdf epub mobi 電子書 下載 -

Dear Mr. Buffett 2025 pdf epub mobi 電子書 下載

Dear Mr. Buffett 2025 pdf epub mobi 電子書 下載 -

ll I Want To Know Is Where I'm Going To Die So I'll Never Go There: Buffett & Munger – A Study in Si 2025 pdf epub mobi 電子書 下載

ll I Want To Know Is Where I'm Going To Die So I'll Never Go There: Buffett & Munger – A Study in Si 2025 pdf epub mobi 電子書 下載 -

像巴菲特一樣滾雪球 2025 pdf epub mobi 電子書 下載

像巴菲特一樣滾雪球 2025 pdf epub mobi 電子書 下載 -

Oracle Speaks 2025 pdf epub mobi 電子書 下載

Oracle Speaks 2025 pdf epub mobi 電子書 下載